How can we save money while not devoting excess time to worrying over our bills? Budgeting is an incredible hack to circumvent money stress. But to budget efficiently, you need to understand how the system works. Setting aside X dollars monthly only goes so far if you know how to account for it. Budgeting experts resort to these 20 factors to conquer the art of mastering their money.

1. Emergency Fund

As emergencies go, you never know when they will happen or how much money they will take from your bank account. Devote an emergency fund to all those unplanned instances like flat tires, medical bills, or anything that, for lack of better terms, throws you for a loop. The emergency fund might tempt you during a shopping spree, but lock it for accountability purposes.

2. Side Hustle

At the beginning of our professional lives, we get to explore the workforce. Many people believe they need to launch right into their lifelong career, but that is a misconception. If you aren’t set on one particular job, take time to dip your toes into various career avenues. Side hustles allow you leeway to increase your income and save more money for later in life.

3. Most Expensive Debt First

When dealing with debt, always pay off the most expensive debt before the more affordable loans. This method follows the debt avalanche phenomenon, where higher debt accrues extreme interest levels and costs you more in the long run. Knock out the larger sums of money before you tackle the small credit card balances.

4. Purchase Necessities

Subscribing to five streaming services a month tempts movie lovers, but that might not pair well with your budget. While settling into a monthly or yearly budget, assess the immediate needs and the wants that take up space in your expenses. Strike out the ones you can live without. Jot down what you need to spend each month, and practice executing that budget for a few months.

5. Goals

You can’t move toward a goal if you don’t know what you want your future to look like. Start with short-term goals, like having $500 in savings, then move on to the long-term ones, like a down payment on a home or paying off a vehicle. Be realistic with your goals. You won’t save $50,000 yearly if that is your yearly income.

6. Budget Before the Month

Get rid of every thought you have about your budgeting skills right now. Throw it away, wave it goodbye, and do what you have to do. You’re starting over, and you’re going to begin to budget before the month rolls around. For example, you will budget for January in the final days of December. Base your plan on your estimated earnings to avoid overplanning or missing any payments.

7. Organize

Do you know how much you truly spend if you don’t keep a tally? Calculate each of your spending habits and keep track of them in a notebook or digital tracker to stay on top of payments. This way, you know what comes out of the bank and where it goes. Accounting for every dollar may seem like a lot of work, but it is a major advantage in scheduling a budget for long-term expenses.

8. Start a Retirement Fund Today

It’s never too late to save for retirement! You may not have a 401(k) yet, but you can formulate your own savings method by opening an account and placing a few dollars in it each week. Depositing $20 a week for a year gives you $1,040 extra dollars annually. In five years, you’ll have $5,200; in 20 years, you’ll have over $20,000.

9. Adjust to Your Needs

Every month looks different, just like every person’s budget follows a different route. You might spend more money on gas than others in one month, so adapt your budget to fit your needs. If you have more money left over, save or splurge: the choice is yours.

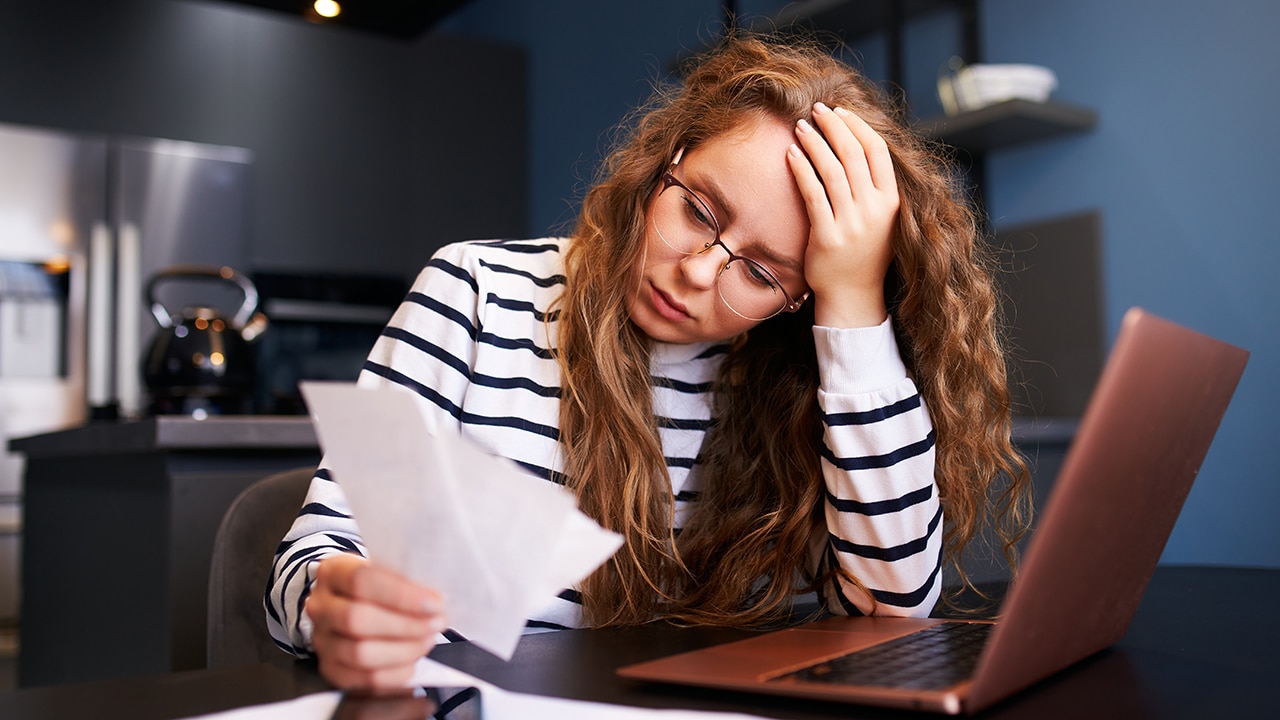

10. Give Yourself Grace

Budgeting is hard. Living a comfortable lifestyle is not the same uncomplicated road it once was. With high inflation rates, you must factor in increasing prices and taxes, making budgeting a stressful activity. Permit yourself time and money to fail. You’re human. You can’t account for every single penny in every paycheck for your entire life.

11. Accountability Partner

Find someone with budgeting goals similar to yours. Form an accountability partner relationship consisting of weekly or monthly check-ins regarding spending and saving habits. Knowing another person fosters a similar mindset can help you remain aware of your choices. Without accountability, you can run into trouble.

12. Stop Comparing

Social media is not real. It’s a highlight reel. Lavish vacations appear that way after numerous edits and several takes of repetitive actions. Just because Miley Cyrus looks ecstatic in her boating outing in Hawaii doesn’t mean she is. Just because your high school colleague looks thrilled in his Dubai post doesn’t mean he didn’t rack up credit card debt to get there. Keep your journey yours.

13. Freeze Your Credit Card

Some people say cutting up your credit card is an unbeatable route. I disagree based on a friend’s horror story. My friend cut up all her credit cards, longing to pay off her debt and soar into financial freedom. When she decided to buy a house, the process took longer due to the absence of credit. Freezing an account permits you to make payments without allowing you to swipe the card.

14. Keep a Piggy Bank

Kids are onto something with those pigs — collecting loose change adds up. I have a jar on my bedside table where I deposit all of the leftover or loose change I find lying around the house, and I roll it into money rolls at the end of each year. I’ve collected between $50 and $200 over the past few years, and I don’t plan on stopping this habit.

15. Watch Tip-Shaming

Picture this. You’re in a market, perusing the aisles, when you stumble upon the perfect gift for your mom. The gift costs $5: a steal, I know! You trot up to the counter, slap down the gift, waiting to hand over your card. After paying, the cashier whips around their tablet, eyes glaring, repeating the phrase, “The tablet will now ask you a question.” You ogle the screen, debating between succumbing to guilt under the watchful eye of this hourly employee or rejecting the tip button, promising to abandon the city you once called home if you refuse to give the hourly employee a $2 tip on a $5 purchase. Don’t fall victim to tip-shaming culture. You don’t have to tip if you don’t want to.

16. See a Coach

Money coaches deal with a variety of people, from horrid budgeters to exquisite savers. Wherever your skills fall on this margin, you are not alone. At a base level, the coach explains the educational portion of budgeting before they speak with you about your goals regarding money. Once you’ve talked about your goals, the coach assists you in designing (and sticking to) a reasonable plan of action.

17. Pay Yourself First

Look out for long-term monetary health by paying yourself first. After the paycheck hits your bank account, divvy up the money into savings, bills, and expenditures. The money you place in your savings account equates to the salary you pay yourself and should go toward your financial future. Financial advisors believe 20% is ideal for saving from each paycheck.

18. Automatic Payments

How often does a payment email pop up, nagging you to pay it in a few days? How often do you fret over forgetting to pay a bill? Eradicate all of this by enrolling in automatic payments. If you stay organized, you’ll understand how many payments you need to automate and the amount withdrawn from your account each month.

19. Budget to Zero

Look at your monthly paycheck and budget each dollar until you reach zero. This clarifies each dollar’s role in your spending habits and emphasizes where you can afford to move money or refrain from spending. If you make $4,000 per month, $1,500 goes to rent, $500 goes to bills, and now you have $2,000. What will you do with the remaining funds? Save $1,000? Spend $1,000 on Legos? However you choose to spend your paycheck, write it down.

20. Don’t Overpay

Did you see a shirt at Target for $20 when the same shirt at Walmart costs $10? Financially-wise people would purchase the Walmart shirt and deposit the leftover cash into their savings fund to maximize financial freedom. Another way to avoid overpaying is to wait 24 hours before making a purchase. Reflect on the potential purchase for 24 hours before making a final decision.

More From List Lovers…

Hidden Treasure: 21 Childhood Toys That Could Be Worth More Than You Think

Best U.S. States for Every Stage of Life, from Starting Out to Settling Down

The post Crucial Budgeting Advice for Every Phase of Life: 20 Must-Know Tips first appeared on List Lovers.

Featured Image Credit: Shutterstock / Ground Picture.