Seniors are often the target of financial scams due to perceived vulnerabilities, such as being less familiar with digital technology or having retirement savings. Scammers exploit these factors, leading to significant financial and emotional distress for the victim. Look at these 15 common money scams targeting seniors and practical advice on staying safe. Awareness and caution are vital in protecting yourself or your loved ones from these deceptive practices.

1. Medicare/Health Insurance Scams

Scammers pose as Medicare representatives to gather personal information or sell bogus health insurance. They might call or email, claiming to need your information for a new card or offering unnecessary services for a fee. Protect yourself by never sharing personal information with unsolicited callers or messages over the phone or email.

2. Counterfeit Prescription Drugs

Online pharmacies may offer cheaper prices, but many sell counterfeit or unsafe medications. These scams cost you money and can also be dangerous to your health. Always buy medication from reputable pharmacies and consult your doctor before trying new medications.

3. Funeral and Cemetery Scams

Scammers read obituaries and exploit grieving widows or family members, claiming the deceased had outstanding debts with them. In another variation, disreputable funeral homes inflate prices or charge for unnecessary services. Ensure you’re dealing with reputable funeral service providers and thoroughly review any contracts or agreements.

4. Fraudulent Anti-Aging Products

Bogus anti-aging products are marketed aggressively to seniors, promising unrealistic results. These can be expensive and ineffective, playing on the fears of aging. Be skeptical of products that promise miraculous results and check with healthcare professionals before using them.

5. Telemarketing/Phone Scams

One of the most common scams involves telemarketers offering fake products or services, such as extended warranties, overpriced goods, or charitable donations. Never give out personal information or credit card details over the phone to unsolicited callers.

6. Internet Fraud

This includes email phishing scams and bogus websites. Seniors may receive emails that appear to be from legitimate companies or institutions asking for personal information. Always verify the authenticity of requests and avoid clicking on suspicious links.

7. Investment Schemes

These schemes promise high returns with little or no risk. Seniors looking to grow their retirement savings are particularly vulnerable. Be wary of unsolicited investment advice and consult a trusted financial advisor before investing.

8. Homeowner/Reverse Mortgage Scams

Scammers target homeowners, particularly those with reverse mortgages. They might offer fake property assessments or pressure you into unnecessary home improvements. Always verify the credentials of anyone offering such services and seek independent advice.

9. Sweepstakes & Lottery Scams

Seniors receive notifications that they’ve won a lottery or sweepstakes but need to pay a fee to unlock the prize. Remember, legitimate lotteries do not require payment to collect winnings.

10. The Grandparent Scam

Scammers call seniors, pretending to be a distressed grandchild needing money immediately. Always verify the caller’s identity and check with other family members before sending money.

11. Charity Scams

These scams involve soliciting donations for fake charities, especially after natural disasters or during holiday seasons. Donate to established, well-known charities, and avoid giving out personal information to cold callers.

12. Utility Scams

Scammers pose as utility company representatives, threatening to shut off service unless immediate payment is made. If you receive such a call, hang up and contact your utility company directly using the number on your bill.

13. IRS Impersonation

Callers claim to be IRS agents and demand immediate payment for unpaid taxes, often threatening legal action. The IRS will never call demanding immediate payment without first sending a bill in the mail.

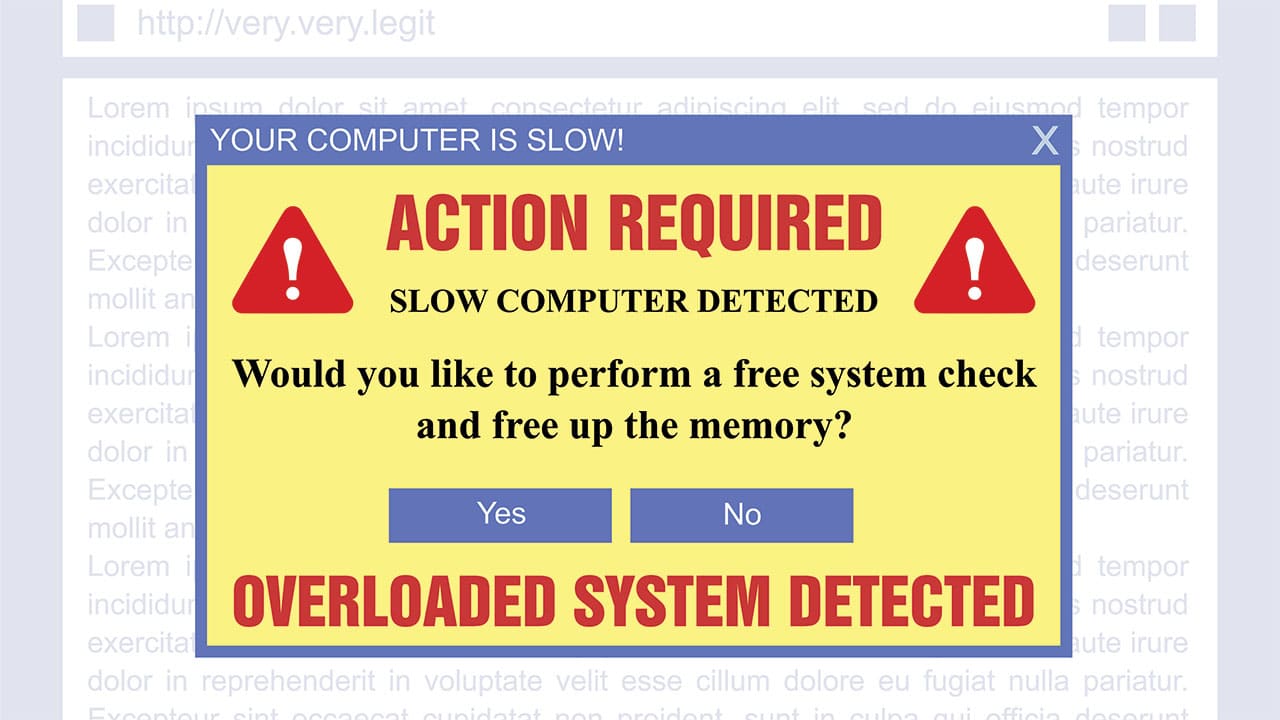

14. Computer Tech Support Scams

Scammers claim to be tech support from a well-known company and insist that your computer has a virus. They ask for remote computer access or payment to fix it. Never give remote access to your computer to unsolicited callers.

15. Romance Scams

Seniors looking for companionship may fall victim to romance scams, where scammers create fake online profiles, build relationships, and eventually ask for money. Be cautious with online relationships, and never send money to someone you haven’t met in person.

More From List Lovers…

Hidden Treasure: 21 Childhood Toys That Could Be Worth More Than You Think

Best U.S. States for Every Stage of Life, from Starting Out to Settling Down

The post Protect Yourself: 15 Financial Scams Targeting Seniors and Ways to Stay Secure first appeared on List Lovers.

Featured Image Credit: Shutterstock / Perfect Wave.